will salt deduction be eliminated

Schumer said that Senate Democrats would make it a priority to permanently eliminate the SALT deduction cap if they are in the majority in 2021. Readers react to an editorial calling for the elimination of the deduction for state and local taxes and discuss how it affects the middle.

House Panel Votes To Temporarily Repeal Salt Deduction Cap The Hill

The Debate Over a Tax Deduction.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

. A host of moderate Democrats say they wont support President Joe Bidens 35 trillion package without a repeal of the cap on state and local tax deductions known as SALT. If I become majority. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

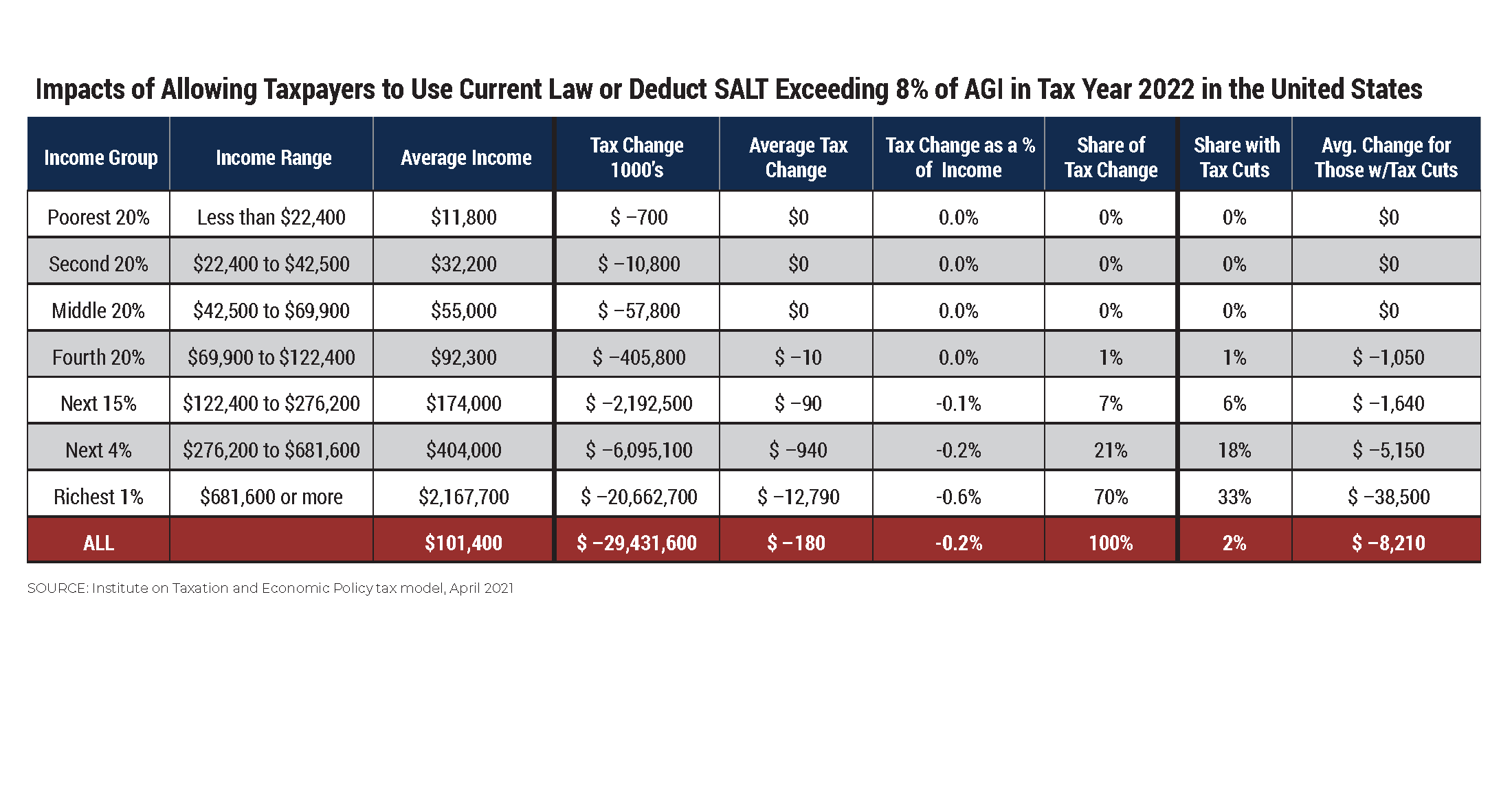

The SALT deduction primarily benefits the upper middle class not 1ers. Eliminating the state and local tax SALT deduction would provide upwards of 15 trillion over the next decade to implement broad-based tax cuts nationally. The truly wealthy have all sorts of other tax shelters at their disposal and many primarily pay capital gains tax.

Combining SALT cap repeal with reinstatement of the Pease limitation and the prior-law AMT substantially reduces those benefits for high earners resulting in a 08 percent. New limits for SALT tax write off. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump.

This significantly increases the boundary that put a cap on the SALT. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a. I want to tell you this.

Over at The Hill our domestic policy studies colleague Howard Husock recently argued that repealing the 10000 cap on the federal tax deduction for state and local taxes. After SALT deductions were capped many people took the enlarged standard deduction and the impetus to contribute to these institutions declined.

State And Local Tax Salt Deduction What It Is How It Works Bankrate

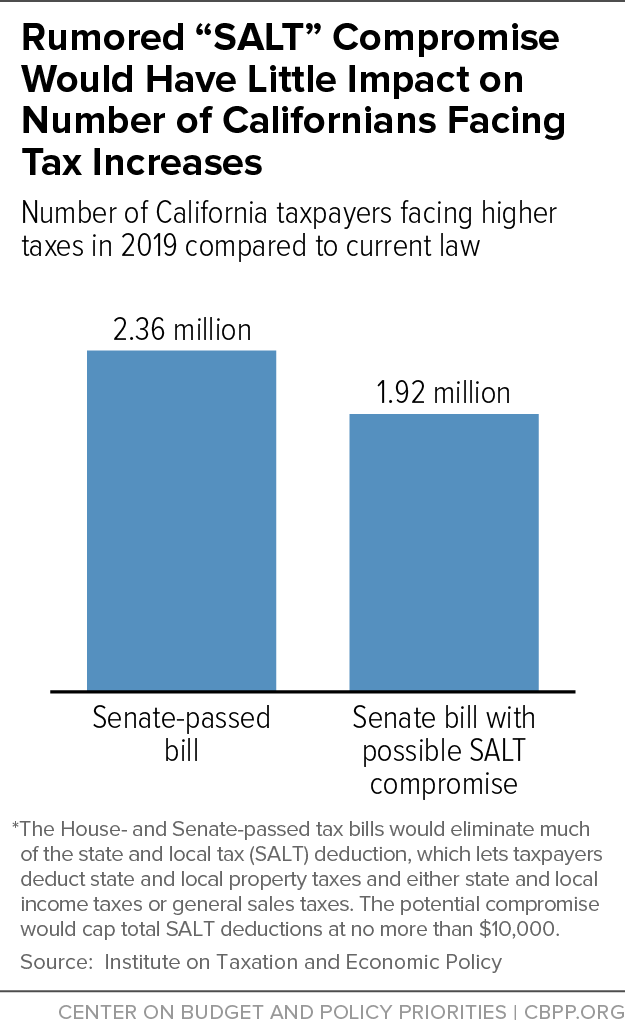

Update California House Members Appear To Be Settling For Bad Salt Compromise Center On Budget And Policy Priorities

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

The Salt Cap Overview And Analysis Everycrsreport Com

Opinion Why Are Democrats Pushing A Tax Cut For The Wealthy The New York Times

Don T Believe False Reports That Say Eliminating The Salt Deduction Would Cost The Average Taxpayer Tens Of Thousands Of Dollars The Heritage Foundation

Schneider Announces Plan To Reinstate Full Salt Deduction Brad Schneider For Congress

Infographic On Tax Deduction Changes For 2018 Dedicated Db

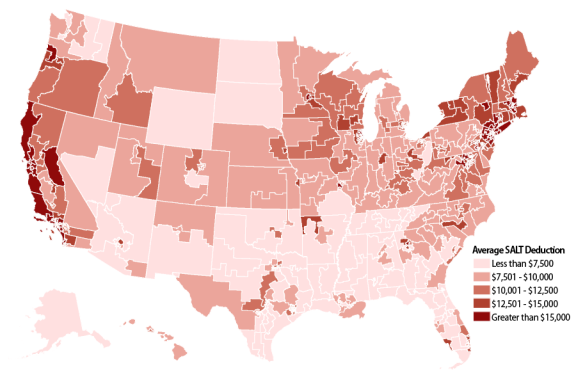

Changes To Federal Salt Deduction Expose Illinois High Taxes

Ending The State And Local Taxes Salt Deduction

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Bernie Sanders Is Mostly Right About The Salt Deduction

Rep Lauren Underwood Homeowners In The 14th District Were Hit Hard By The Republican Tax Law That Unfairly Harms Middle Class Families The Law Created A Cap For The Amount Of State

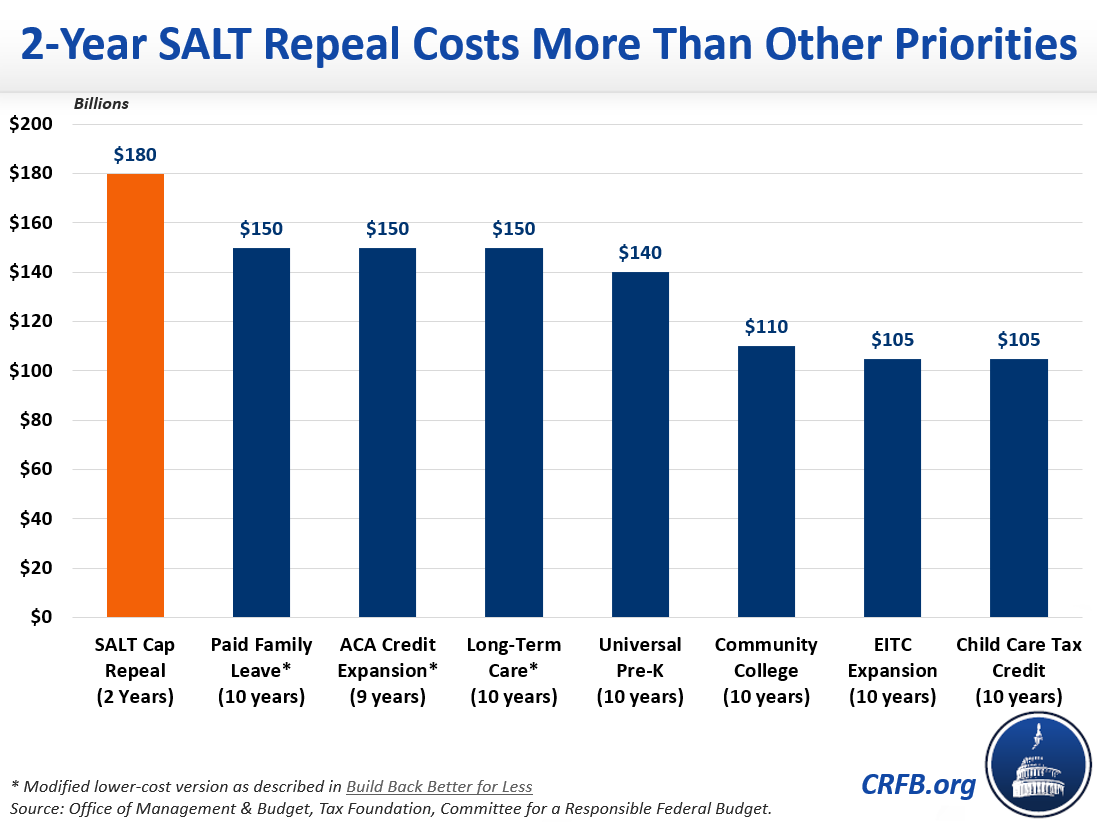

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Unlock State Local Tax Deductions With A Salt Cap Workaround Green Trader Tax

How Does The State And Local Tax Deduction Work Ramsey

Schumer S Fight Against The Salt Deduction Cap Fails Top Stories Nny360 Com

House Votes To Eliminate Salt Deduction Cap Offering Relief To New Jersey And Other High Tax States